46 to 48: The Biggest Project In Trinidad Looks To Get Bigger

UrbanTurf Staff | 1:12 PM EDT

The residential development in the works along Florida Avenue NE is looking to increase the total number of apartments to 48.... read»

Just 10 Residences, From the Low $300s, Debut in the Heart of Petworth

UrbanTurf Sponsor | 11:36 AM EDT

In a sought-after Petworth location—steps from the Petworth farmers market, the Petworth Metro Station and Upshur Street’s busy restaurant row—a... read»

Best New Listings: Steps From The Capitol; Looking Good Off U Street

Ashley Hopko | 9:12 AM EDT

This week's Best New Listings includes a colorful townhouse off U Street, a home at the base of the U.S. Capitol and condo in Hill East.... read»

Get the (free) newsletter:

Get the (free) newsletter:

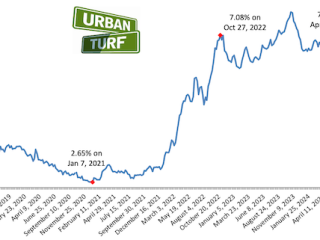

Mortgage Rates Rise Above 7% For First Time This Year

UrbanTurf Staff | April 18th

Freddie Mac reported 7.10% as the average on a 30-year mortgage, up 22 basis points from last week. It is the first time since December that rates hav... read»

UrbanTurf Listings: New This Week

UrbanTurf Staff | April 18th

UrbanTurf Listings is a premium property listings service that showcases some of the most appealing for-sale homes from across the DC metropolitan are... read»

Thursday's Must Reads

UrbanTurf Staff | April 18th

Airbnb's push to build condos; the Virginia town that Gen-X loves; and Ohtani's Hawaii home.... read»

First-Timer Primer: DC's Home Buyer Assistance Programs

UrbanTurf Staff | April 17th

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer Primer aims to provide some clarity.... read»

388-Unit Development At Site of North Capitol Street Exxon Nears Completion

UrbanTurf Staff | April 17th

Plans for the development at a prominent DC intersection began nearly eight years ago.... read»

Wednesday's Must Reads

UrbanTurf Staff | April 17th

Amazon HQ2 shed hundreds of jobs last year; 2,000 acre Blue Ridge Mountain estate sells for nearly $19 million; and the outlook for DC restaurants.... read»

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Plans for the development at a prominent DC intersection began nearly eight years ago... read »

The eight-bedroom, 35,000 square-foot home in McLean originally hit the market in 202... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro