The 6 Places In The DC Area Where You Aren't The Only One Bidding On a Home

UrbanTurf Staff | 1:07 PM EDT

Today, UrbanTurf is examining one of our favorite metrics regarding competition in the housing market to find the places in the DC region where homes ... read»

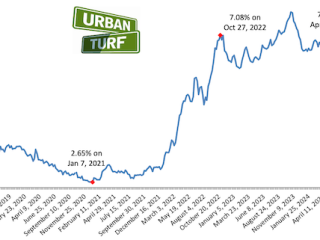

Mortgage Rates Rise Above 7% For First Time This Year

UrbanTurf Staff | 12:01 PM EDT

Freddie Mac reported 7.10% as the average on a 30-year mortgage, up 22 basis points from last week. It is the first time since December that rates hav... read»

UrbanTurf Listings: New This Week

UrbanTurf Staff | 9:12 AM EDT

UrbanTurf Listings is a premium property listings service that showcases some of the most appealing for-sale homes from across the DC metropolitan are... read»

Get the (free) newsletter:

Get the (free) newsletter:

388-Unit Development At Site of North Capitol Street Exxon Nears Completion

UrbanTurf Staff | April 17th

Plans for the development at a prominent DC intersection began nearly eight years ago.... read»

Wednesday's Must Reads

UrbanTurf Staff | April 17th

Amazon HQ2 shed hundreds of jobs last year; 2,000 acre Blue Ridge Mountain estate sells for nearly $19 million; and the outlook for DC restaurants.... read»

This Week's Find: An Alley Home on the Hill That Used To Be a Refrigeration Plant

Siddhi Mahatole | April 16th

614 A Street SE Rear was purchased by artist Walter Kravitz and his wife Judith Harris in the late 1980s and converted into a home.... read»

What Are Pocket Listings?

UrbanTurf Staff | April 16th

Pocket listings are growing in popularity in the low-inventory market in the DC region.... read»

Carr Properties Moves Forward With 234-Unit Alexandria Development

UrbanTurf Staff | April 16th

The Old Town development originally pitched back in 2021 is moving forward.... read»

Tuesday's Must Reads

UrbanTurf Staff | April 16th

The battle for a Chevy Chase historic district; a DC developer vies for a Virginia casino; and what is hurting the solar market.... read»

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Margarite is a luxury 260-apartment property known for offering rich, high-end reside... read »

The owner of 700 Monroe Street NE filed a map amendment application with DC's Zoning ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro